Are you thinking about making an investment in a startup that allegedly uses AI or machine learning and would like a completely impartial assessment of their actual AI technology or products?

If so, then it’s absolutely vital that you have an evaluation done of that company’s technology stack and this is where technical due diligence comes in. However, this needs to be done concurrently with a traditional due diligence exercise.

When you hire a data science and data strategy consulting specialist to conduct AI due diligence, it’s important to know a few points of consideration beforehand such as:

And many other similar questions – which will give you insights into whether the company is worth investing in or acquiring.

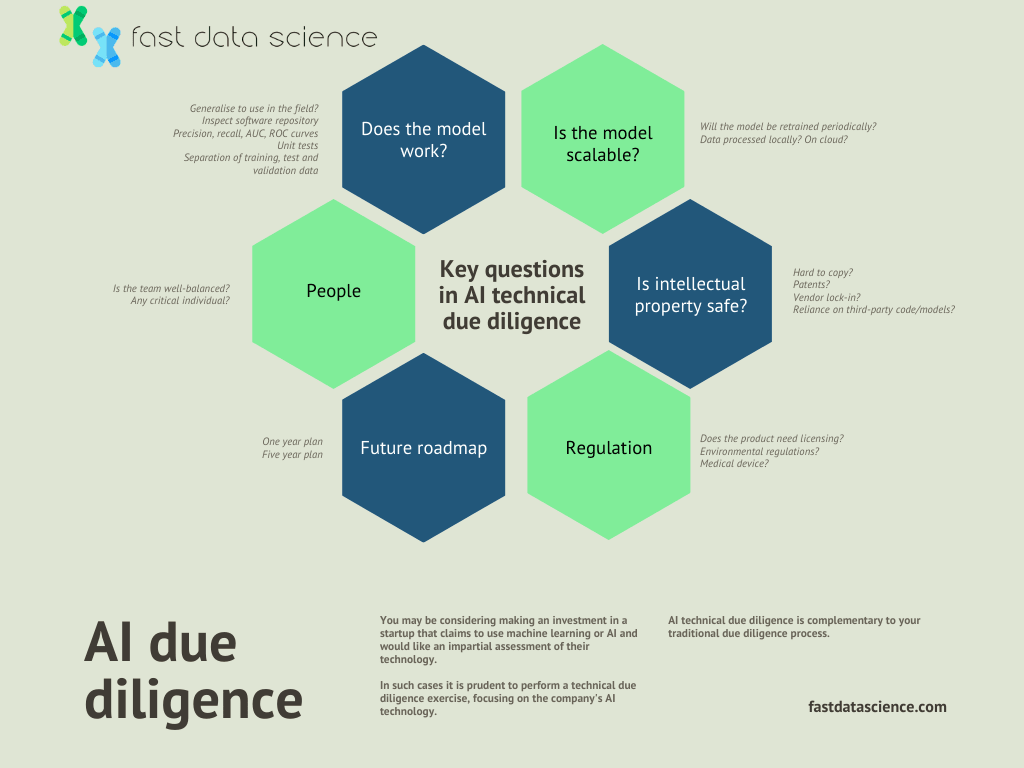

Some of the key questions that should be asked in an AI technical due diligence exercise.

As an investor and dealmaker, you need to stop for a moment and think critically as well as strategically:

Depending on your own business strategy, there may be many reasons for acquiring AI products and technologies or investing in them:

Before we proceed further to discuss the underlying value and importance of performing technical due diligence on AI companies, it pays to understand the upward trend of investing in and acquiring companies who own or have access to AI products and technologies.

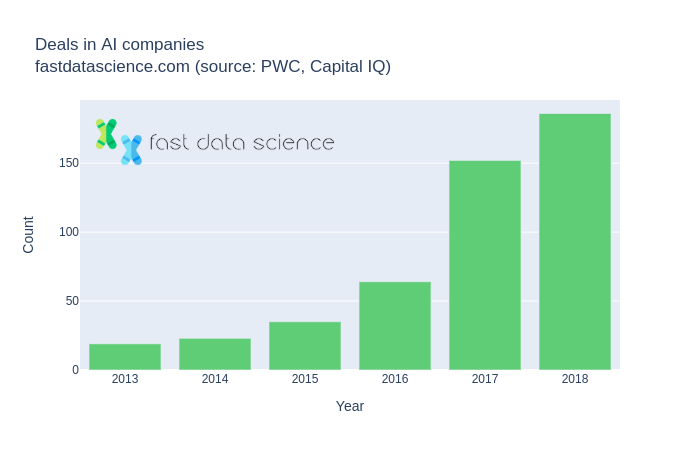

From 2013 to 2018 the number of deals in AI companies increased significantly, and all of these will have required a machine learning due diligence process. Data source: PWC.

As artificial intelligence continues to become more advanced and sophisticated, deals involving the technology are not just an opportunity but a challenge as well.

Investors and dealmakers need to be weary and specifically put a laser-like focus on two essential stages of the transaction – i.e. pre and post-deal.

Interestingly, seeing how artificial intelligence is an emerging technology that businesses are just starting to leverage, its roots can be traced back to more than 60 years. It’s only now that companies have started harnessing AI’s power and aim to expand their presence through it.

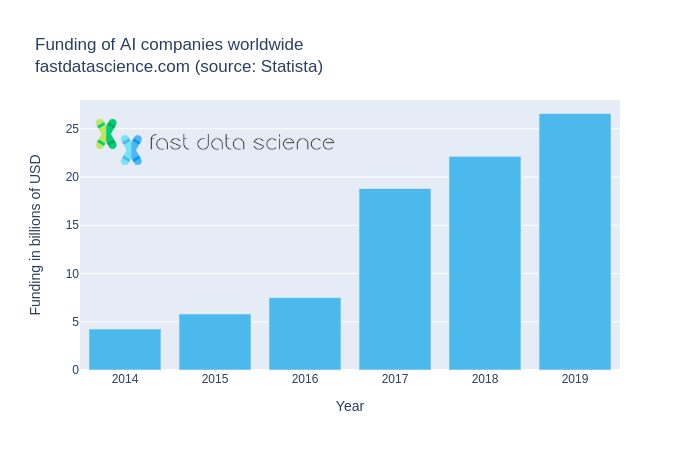

The amount of funding injected in AI companies by investors also increased rapidly from 2014 to 2019. Data source: Statista

In fact, between 2013 and 2018, the number of deals closed involving companies with their feet deep in AI increased massively as specific technological innovations made it accessible to more people in general. In the meantime, venture capital investments in AI-based startups have also risen at a steady pace – a clear signal that the AI acquisitions market will remain strong as organizations mature and get closer to their exits.

According to a 2019 AI Predictions survey on US business executives conducted by PwC, the majority of large-scale tech companies believed AI will improve productivity – and in 2020, we are seeing this unfold in front of our very eyes. Incorporating AI into the workplace can potentially increase productivity by 40% or more. In addition, the AI market is estimated to grow by 50% YoY in the next 5 years.

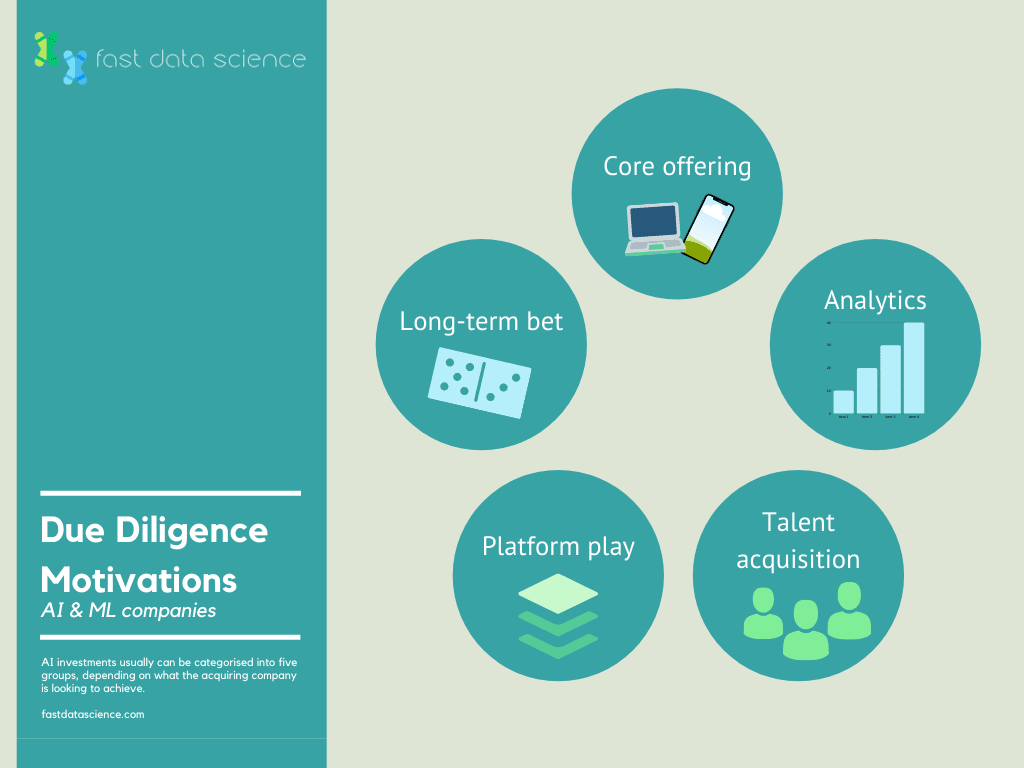

The five common motivations for investments in AI companies

Whether you’re looking to acquire data, analytics or just talent, recent AI investments can be categorised in five ways:

At the moment, dealmakers and AI technology investors are rather self-assertive and overly positive about AI – which is why many fail to perform the necessary technical due diligence before jumping headfirst into a deal.

The fact of the matter is acquirers and dealmakers must evaluate the feasibility and success of a transaction through a very unique lens – otherwise, their investments may not bear fruit the way they had hoped or expected.

It’s perhaps no secret that deals involving AI often don’t turn out to be what the buyer had expected. In a 2019 MMC Ventures report, it was revealed that in over 2,000 European startups, 40% had no AI capabilities at all.

Fast Data Science - London

There are many, many nuances to an AI deal, which is what makes the transactions truly unique. Dealmakers, therefore, must rethink the entire deals process by first gaining access to and evaluating all the various technology details – some of which we touched upon in the beginning of the article – and second, by evaluating specific data of the target company. This is where due diligence and artificial intelligence often come up in the same sentence.

Furthermore, the integration plans themselves should take a thorough look at responsible AI principles and practices – helping the buyer extract as much value from the deal as possible and that too well beyond the deal-closing stage.

If you want the acquisition to be successful, then you must develop an extensive and rigorous method which will help you evaluate the transaction from start to finish. Not just that, but the process should get a diverse set of experts involved, including product managers, data scientists, data strategists, technologists, financial experts, etc. who can fully assess whether the target company’s AI strengths are actually capable of performing as claimed.

When you have a diverse group of experts to advise you, deals can be evaluated through a variety of angles, addressing critical questions like:

Even though AI in itself isn’t capable of working properly unless underpinned by the right data – it’s still not unheard of for target companies to make huge promises regarding the uniqueness and accessibility of their AI assets.

This is where data scientists and strategists, as well as technologists and product managers can be a part of your technical due diligence efforts in order to assess how a target’s data compares with competing companies in the market.

The fact that dealmakers should only enter AI acquisitions on guard and with eyes wide open is further supported by a recent deal where the level of collaboration explained above paid off in massive ways:

An upcoming tech company wanted to acquire an AI-based cybersecurity company – while the latter did have the capabilities they made claims to, after due diligence, it was discovered that the technology was no different or unique as it might have been a few years ago. Unless an integrated due diligence process had not been in place, this would never have come to light. The product technology diligence team collaborated regularly with the commercial diligence team to conduct customer interviews and evaluate both the competitive and commercial aspects of the company.

However, there’s a lot more to successful AI mergers and acquisitions than just hiring the right team of data scientists and strategists. In order to gain optimal value from a transaction, you must also put a keen focus on responsible AI.

This generally begins with an integration strategy which takes into account the evolving sophistication and nature of AI technology. This strategy will not only highlight when/how the assets and operations of a buyer will collectively come into play – but also shed light on how the newly acquired company will deal with regulations and social standards that may influence AI’s future.

Now, as you might imagine, the rise of AI brings along with it a number of challenges revolving around trust and accountability with not only customers, but also entire governments and any other stakeholders. To effectively mitigate these risks, buyers acquiring AI capabilities need to implement a governance system which, in essence, address certain practices and principles of “responsible AI”:

Any bias in an AI-driven company, like gender discrimination during the hiring process, is a major red flag when it comes to the inherent risks associated with acquiring AI companies. And this bias can translate across the board. For example, certain biases can be evident in datasets used for training algorithms – either because that data does not truly represent reality or reflects pre-existing prejudices.

Let’s say the AI is responsible for driving the company’s internal employee hiring tool, and the algorithm was programmed on the basis of making historical decisions which favored male employees over female ones; if this happens, then there’s a very high likelihood that the recruiting tool will mimic that algorithm, verbatim.

In order to reduce such risks as much as possible, dealmakers must determine if there are plans in place to ’tune and balance’ those AI systems so that any such bias are eliminated altogether – and to also ensure that decisions are being made around that AI system/product in accordance with the company’s code of conduct, and general anti-discrimination regulations in their sector.

Furthermore, it’s critical that the target company is persistently testing those AI systems for any bias in data and models, as well as how people are using the algorithms associated with it.

When we talk about AI systems, we must bring safety and security into the picture. The entire value proposition revolving around an AI deal often relies on the assumption that the AI data being acquired is 100% protected and not tampered with.

However, it can sometimes be difficult to assess just how safe and secure those AI systems are. Therefore, dealmakers should work with the relevant AI technical due diligence team to evaluate if the target company’s AI systems are vulnerable to cyberattacks, in addition to whether the proper safety controls have been put in place.

Naturally, all the respective CISOs (Chief Information Security Officers) need to be involved early on in the deal, so that the data scientists and security experts can help the dealmakers understand any potential interactions between the acquiring company and target company’s technologies.

Dealmakers must coordinate with both the acquirer’s and target company’s compliance departments, as well as other stakeholders to better understand ongoing and developing regulations.

Let’s take privacy laws, for example.

As the acquirer and target AI company combine key data sets to fuel the AI, it will become crucial to determine whether the systems comply with the EU’s GDPR policies, the CCPA in California, along with any other privacy laws that come into play. If the systems are not in compliance, then either the acquirer or target (or both) should look for mitigating solutions like anonymizing data, for example.

Some additional research may be required on your part to determine which legislations apply – although your technical due diligence team can offer further guidance in this regard.

At some point, the AI company may be required to explain why a specific AI model or system made a particular decision. As a dealmaker, you should be able to pull specific information around this from the target AI company’s data scientists, management, and others who have knowledge on the various AI models – in order to understand why the said AI model reached a specific decision.

This is necessary because you must tailor the explanation to all your respective stakeholders, including business sponsors, regulators and end users. When you do this, it inspires a lot of confidence amongst the employees and consumers of the newly acquired AI technology – and also offers further protection to the acquisition’s overall value.

Therefore, as an acquirer or dealmaker, it’s important to ensure that the AI product or technology you’re buying is not merely a black box – but something which can easily be reverse-engineered and understood well by your own data scientists and/or external team of technology and data experts.

So now that we have all that “good stuff” out of the way, we’re left with this pressing question:

how can acquirers and dealmakers extract the most business value from AI?

Or, perhaps:

how can AI be used to gain a competitive edge?

Answers to such questions are not only sorely needed but also challenging to find. Like other assets in your company or portfolio, AI does not boast any economic value per se. Rather, it’s a tool which can help the acquiring company generate more revenue for shareholders.

The commercial value that AI offers through its various aspects isn’t some black box that companies are unable to crack. You see, economic value and business value are complex, multifaceted concepts, but there are parallels to be found which can be narrowed down to: growth, profitability, innovation, ROI, commercial models, pricing and company reputation.

What you require is a straightforward process for exploring potentially “low hanging fruits” and working on them straight away to extract the most value from your AI acquisition. This starts with three key elements:

Have you built your business around cost leadership or a relentless focus on meeting customer needs every time? Is fast growth the norm in your industry or do you rely heavily in R&D, product innovation and quality?

Carefully think about the most important elements that will be revolving around your business in the next few years and how, as a result, you will generate the most value possible for your customers and stakeholders.

The choice you have made will act as a good starting point in how to extract value from AI. Starting with something familiar always makes more sense. In addition, you would want to consider the key drivers of the sector you are in. if you’re in the retail industry, for instance, you can create commercial value through AI by optimizing advertising and inventory or by forecasting consumer demand. If you’re in the goods manufacturing sector, you might gain value from AI in automating production or optimization of logistics.

So, how you take your commercial approach towards AI is essentially determined by the very nature of your business, the sector you are in, your position alongside competitors and the direction you are planning to take in the next few years.

It’s important to assess your AI maturity level. For example, do you currently know how to leverage the algorithms, data management processes, and data infrastructure – or the management agenda to help maximise the value of AI all across your organisation?

You may need to refer to the first element, and again, think about what you want to achieve, along with other sub-elements around your cost control, revenue growth, asset efficiency, etc.

You can now map these two together; i.e. your AI maturity level (what you have in hand) and your commercial objectives or value proposition you seek (what you want). When you map these two together, it can help you identify how your current AI assets could be potentially transformed into commercial value.

It may also help you come to terms with where the obvious gaps are, and the action to take in order to fill them. Let’s say there are noticeable gaps between your AI maturity level and your commercial objectives – in that case, you would want to build your entire commercial approach towards AI based on existing strengths.

After you have mapped out the nature of your business, along with your objectives and assets as well as your competitive edge, you can now work on coming up with specific tactics that best capture commercial value before and after the AI acquisition.

As with the previous elements, there are certain aspects to consider: would it be better to make a direct profit by selling your newly acquired AI assets to customers? Or would it be better to make an indirect profit by optimizing your current commercial operations?

Your technical due diligence team for AI can help you determine the correct tactics, along with all the respective elements that come into play – in order to help you extract the maximum value from AI acquisition or merger.

On a final note – before you even consider a transaction, you must evaluate the potential deal’s rationale, namely:

Why should I buy XYZ AI company?

There are risks that come with an AI company acquisition, but more importantly, you should be buying what you think you’re actually buying.

This means working with an expert team of data scientists and strategists as well as product managers, financial experts and technologists to evaluate the deal from multiple angles.

Your work isn’t quite finished once the deal concludes as you need to do everything possible to preserve the post-deal value. This entails a comprehensive integration plan which includes applying responsible AI and operationalizing AI as well.

The team at Fast Data Science is ready to help you build your AI assets, create the most commercial value and improve your competitive standing too.

Ready to take the next step in your NLP journey? Connect with top employers seeking talent in natural language processing. Discover your dream job!

Find Your Dream Job

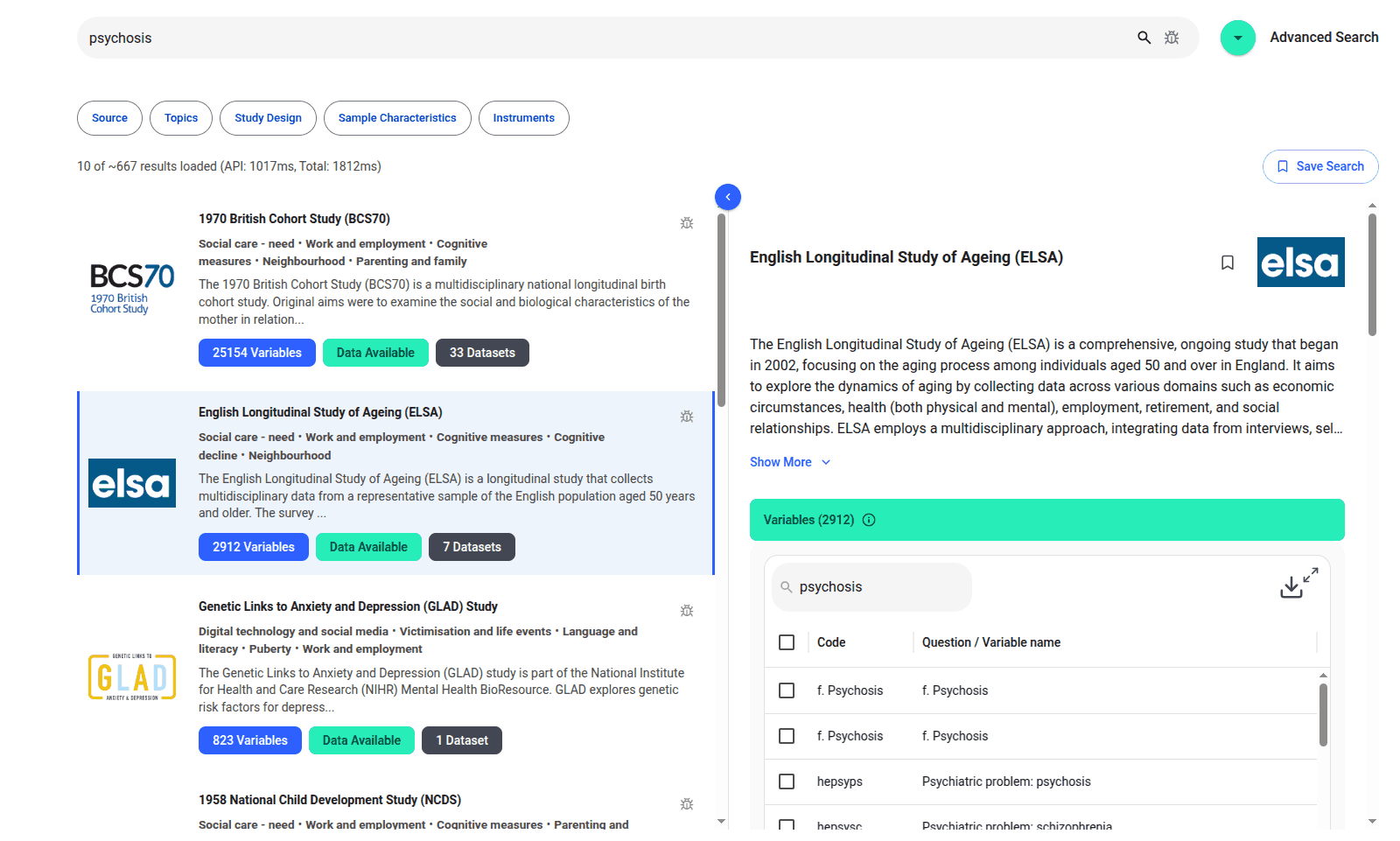

We are excited to introduce the new Harmony Meta platform, which we have developed over the past year. Harmony Meta connects many of the existing study catalogues and registers.

Guest post by Jay Dugad Artificial intelligence has become one of the most talked-about forces shaping modern healthcare. Machines detecting disease, systems predicting patient deterioration, and algorithms recommending personalised treatments all once sounded like science fiction but now sit inside hospitals, research labs, and GP practices across the world.

If you are developing an application that needs to interpret free-text medical notes, you might be interested in getting the best possible performance by using OpenAI, Gemini, Claude, or another large language model. But to do that, you would need to send sensitive data, such as personal healthcare data, into the third party LLM. Is this allowed?

What we can do for you