You may have read my previous post about customer churn prediction. Another similar problem that’s just as important as predicting lost customers, is predicting customers’ daily expenditure.

Let me give you an example: you work for a large retailer which has a loyalty card scheme. You’d like to predict for a given customer how much they are likely to spend over the next week.

In this case normally there would be clear patterns

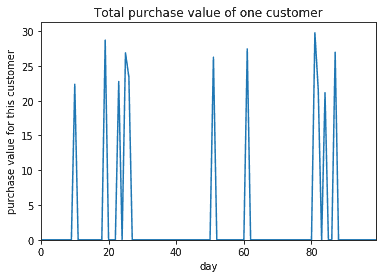

However there are a few problems when you get down to customer level:

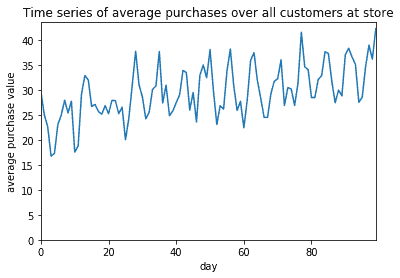

What this means is that, if you look at all customers’ expenditures (or averaged over a region), you will probably see some recognisable weekly, monthly and seasonal patterns:

However for a single customer it’s hard to make out any recognisable pattern among all the noise. The weekly and yearly trends were only apparent when we averaged over all customers.

Fast Data Science - London

So how can you go about predicting the future expenditure of a given customer the next time they enter the shop?

This problem is quite interesting as there are at least two very different approaches to solving it, from two different traditional disciplines:

This means that depending on whether you hire somebody with a machine learning background, or somebody with a statistics background, you may get two contradictory answers.

In this post I’ll talk only about the predictive modelling approach.

If you are interested in predicting the first graph, which is averages for groups of customers, you might want to look into my next post on time series analysis.

The simplest way would be to use a predictive modelling machine learning approach. For example you could use Linear Regression. If you are unfamiliar with how to do this I recommend Andrew Ng’s Coursera course.

You would provide as input to your Regression model:

The output you want it to predict is:

This will predict the next purchase with some accuracy. After all the biggest factor to predict what someone will buy, is what they bought in the past.

However I’m sure you can easily think of some cases where this will break down. For example

You can improve the performance of the Predictive Model approach by making it a little more sophisticated:

If you have a prediction problem in retail, or would like to some help with another problem in data science, please contact me.

In practice it can be tricky to get the data on each customer that I described above. You need to extract certain statistics on customers’ past purchases from your database to train your model, and also query your database in real time to run a prediction. If you would like more ideas on how to do this please check out my video on the topic or this Python tutorial on Github, or read more about AI in business on our blog.

Unleash the potential of your NLP projects with the right talent. Post your job with us and attract candidates who are as passionate about natural language processing.

Hire NLP Experts

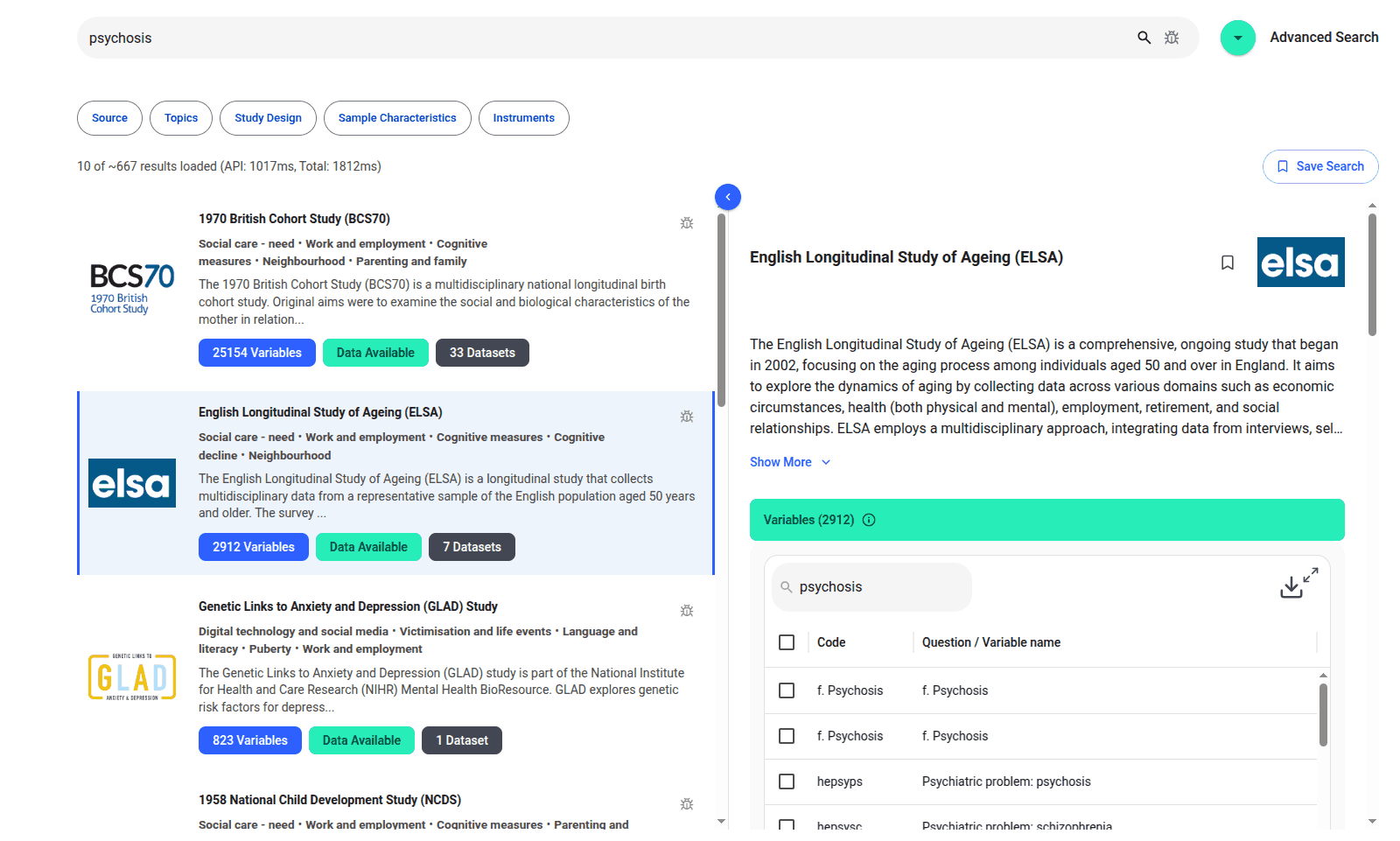

We are excited to introduce the new Harmony Meta platform, which we have developed over the past year. Harmony Meta connects many of the existing study catalogues and registers.

Guest post by Jay Dugad Artificial intelligence has become one of the most talked-about forces shaping modern healthcare. Machines detecting disease, systems predicting patient deterioration, and algorithms recommending personalised treatments all once sounded like science fiction but now sit inside hospitals, research labs, and GP practices across the world.

If you are developing an application that needs to interpret free-text medical notes, you might be interested in getting the best possible performance by using OpenAI, Gemini, Claude, or another large language model. But to do that, you would need to send sensitive data, such as personal healthcare data, into the third party LLM. Is this allowed?

What we can do for you